Contents

- Time Matters More Than Ever in Drone Operations

- What Actually Happens After a Drone Incident

- Why Claims Handling Structure Can Affect Your Claim

- What In-House Claims Handling Actually Changes

- Where Claims Delays Usually Come From

- How Coverdrone Manages Drone Insurance Claims in Practice

- Real-World Example: Equipment Damage During a Live Commercial Shoot

- For Insurance Brokers Advising Drone Clients

At Coverdrone, we work with drone operators, businesses, and insurance brokers across the world, with over 250,000 policyholders worldwide. Some fly occasionally. Some have one drone they use every day. Some have whole fleets. Others operate at scale, under contract, with clients, crews, and deadlines depending on them.

Across all of those use cases, one truth holds fast:

“Insurance only really proves its value when something goes wrong.”

Buying a policy should be straightforward, and it’s an experience we’ve put real thought and care into. Claims are where things get real and potentially complex.

For commercial drone operators in particular, incidents rarely happen in neat, contained moments. They happen mid-project. On live sites. With people waiting. With money already committed. In those situations, how a claim is handled can matter just as much as what the policy says.

This article explains why claims handling matters, how in-house claims management improves real-world outcomes, and why Coverdrone has made claims handling a core part of how we support drone operators.

Time Matters More Than Ever in Drone Operations

Drone technology has changed how businesses work because, in addition to the potential for increased safety and reduced costs, it saves time.

According to the Global State of Drones 2025 report from Drone Industry Insights, saving time is now the number one reason organisations adopt drones. Faster inspections. Quicker data. Less downtime.

That same expectation applies when something goes wrong.

When an incident interrupts a job, policyholders don’t just want a claim logged. They want clarity. They want to know what happens next. They want to understand how quickly the drone can get moving again, or how to manage the situation professionally if they can’t.

Claims handling that recognises this pressure makes a real difference.

Clients expect clear communication and professionalism under pressure, so insurance that supports those expectations and responds quickly becomes an essential part of an operator’s professional toolkit.

What Actually Happens After a Drone Incident

From the outside, a claim can sound simple. In reality, drone claims often involve multiple moving parts, particularly for commercial drone operators.

Even when there’s no injury or third-party damage, an incident may involve:

- Specialist drones and payloads

- Software and firmware considerations

- International locations

- Commercial delivery timelines

- Client expectations

Some parts of the process require independent assessment. That’s normal in insurance and aviation. What varies is how the overall process is managed.

From the policyholder’s point of view, the experience often comes down to three practical questions:

- Who am I dealing with when I make a claim on my drone insurance?

- What happens once I have submitted the claim?

- How long does a claim take to process?

Clear answers to those questions reduce stress, uncertainty, and disruption.

Why Claims Handling Structure Can Affect Your Claim

Across the insurance market, claims can be handled in different ways.

In some cases, responsibility is spread across several organisations. In others, a central team takes ownership of the claim and coordinates any specialist involvement required.

That structural difference shows up in day-to-day experience.

It affects:

- How many people an operator has to speak to

- How often the same information is repeated

- How clearly the next steps are explained

- How quickly uncertainty is reduced

Delays are rarely about effort. They’re usually about coordination.

For commercial drone operators, where time, money, and reputation are all on the line, that distinction matters.

What In-House Claims Handling Actually Changes

Coverdrone has a dedicated in-house claims team. That’s not a marketing add-on. It’s a deliberate choice based on how drone operations work in practice.

The benefits show up in simple, practical ways.

• One clear point of contact

From first notification onwards, policyholders deal directly with Coverdrone’s claims team.

Even where specialist assessment forms part of the process (for example, an appointed loss adjuster might need to contact the policyholder), the claims team remains the primary point of contact. Policyholders aren’t left managing multiple conversations or chasing updates across different organisations.

• Claims handled by people who understand drones

Drone claims aren’t generic. They involve aircraft, software, payloads, and operating environments that don’t necessarily fit neatly into standard insurance categories.

An in-house team that works exclusively with drone policies understands those realities. That helps ensure the right information is gathered early and reduces unnecessary back-and-forth later.

• Faster clarity, not rushed decisions

Speed in claims handling isn’t about cutting corners – it’s about clarity.

A specialist in-house team knows what information is needed, what the process looks like, and what to expect next, allowing policyholders and operators to plan, communicate with clients, and make informed decisions while a claim progresses.

• Less disruption when things go wrong

Incidents are disruptive by nature. In-house handling helps limit that disruption by reducing duplication, improving communication, and keeping operators focused on their work rather than the mechanics of a claim.

Where Claims Delays Usually Come From

It’s easy to assume delays are caused by complexity alone. In reality, delays more often come from friction in the process.

Common causes might include:

- Information being requested multiple times

- Unclear ownership of next steps

- Misalignment between policy intent and assessment

- Multiple organisations having to pass information around

- Operators being asked to manage coordination themselves

Good claims handling removes as much of that friction as possible, and central coordination makes that easier.

How Coverdrone Manages Drone Insurance Claims in Practice

As a specialist drone insurance provider, Coverdrone manages claims through its own dedicated in-house team.

That team:

- Acts as the main point of contact for customers

- Manages claims directly wherever possible

- Coordinates with specialist assessors when required

- Works closely with underwriting and policy wording

From the policyholder’s perspective, this creates continuity. There’s clarity about who is responsible, what information is needed, and how the claim is progressing.

How a claim is handled can matter just as much as what the policy says, especially under the pressure of something going wrong. That matters when projects are live and time is critical.

Do you have questions about claims at Coverdrone? Visit our Claims FAQ page for more information.

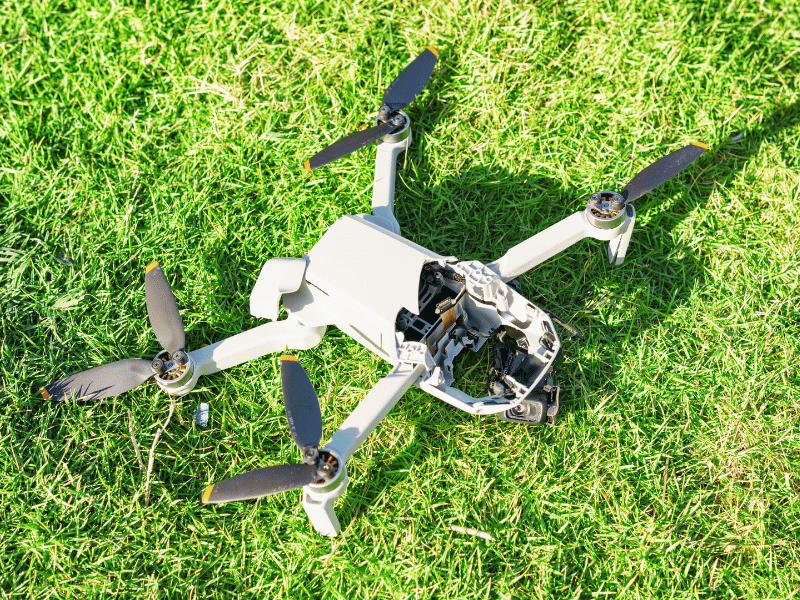

Real-World Example: Equipment Damage During a Live Commercial Shoot

Details in this example have been anonymised and locations removed to protect client confidentiality.

A commercial drone operator specialising in photography and film was working on a high-profile advertising shoot overseas. Production was already underway, with cast, crew, and equipment on site, and some aerial footage had been captured successfully earlier in the day.

During a subsequent take-off, the drone experienced an unexpected issue moments after leaving the ground, rolled to one side, and fell into steep terrain nearby. The drone was recovered shortly afterwards, but it had sustained damage and was no longer safe to operate.

There was no injury and no third-party damage. However, the impact was immediate. The shoot was live, time-critical, and involved significant commercial investment. Any prolonged delay risked disrupting the schedule and increasing costs.

The operator contacted Coverdrone to notify the incident. From that point, the claim was managed directly by Coverdrone’s in-house claims team, who acted as the single point of contact throughout.

The initial focus was on clarity and coordination. The team worked with the operator to understand the equipment involved, the nature of the damage, and the practical constraints of the shoot. As part of the assessment process, it was later identified that a software issue had caused an input to be misinterpreted by the drone.

Where specialist input was required, this was coordinated by Coverdrone rather than passed back to the operator. In parallel, practical steps were taken to support continuity of operations, including supporting the sourcing of a suitable replacement drone and coordinating logistics. As a result, the claim was dealt with very quickly, and shooting resumed.

Throughout the process, the operator had clear visibility of the next steps and realistic expectations about how the claim would be handled. While incidents like this are disruptive by nature, having the claim managed in-house helped reduce uncertainty at a critical moment and allowed the operator to stay focused on delivering the work on site.

For Insurance Brokers Advising Drone Clients

When advising drone clients, it’s worth considering:

- Whether there is a single claims contact throughout the process

- How well the claims team understands drone operations and equipment

- Who coordinates specialist assessment when required

- How quickly clients receive clarity on next steps

Even where specialist assessment is required, central claims coordination can reduce delays and improve the overall client experience. This is where specialist in-house claims handling can make a real difference.

For clients operating under commercial pressure, that difference can be significant.

Summary

Insurance is easy to value when everything is going well. It matters most when it isn’t.

How a claim is handled affects confidence, continuity, and credibility. In-house claims handling, like we have at Coverdrone, provides clarity, expert coordination, and consistency at moments when those things matter most.

At Coverdrone, our claims team is built around the realities of drone operations. That focus is intentional, and it reflects our role as a specialist drone insurance provider supporting operators worldwide.

Ready to Look at Cover that Works When it’s Needed?

If you want to understand how Coverdrone’s claims handling approach supports commercial drone operations, you can explore your cover options and get a quote online.