Finding the right commercial drone liability insurance is essential for safeguarding your business. But with so many policy options and providers available, knowing what to look for can be overwhelming. In this blog, we highlight some of the key questions to ask when evaluating your options, to ensure you get the right level of support and protection should something ever happen.

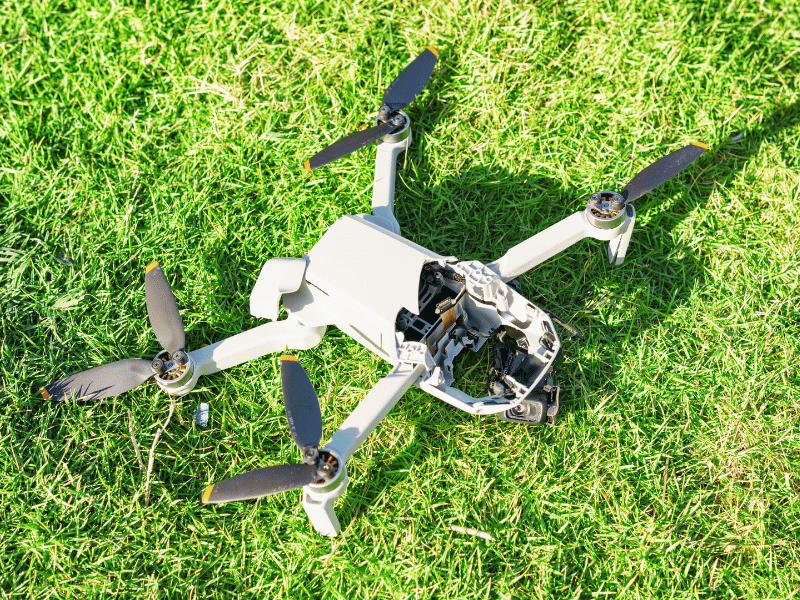

1. Does it also give the option to insure your equipment against accidental damage and loss?

Does the policy only provide cover if you were to injure a third party or damage someone else’s property? Consider if this is enough protection for your own needs, and what you would do if you accidentally damaged or lost your equipment, or if it were stolen.

2. What liabilities does it actually cover you for?

Check if the policy also provides cover for product liability and aviation liability? Or is the liability cover restricted solely to claims if you were to injure a third party or damage someone else’s property? If it’s the latter, consider if this is enough protection for your own needs.

3. Would it be cheaper to get a short-term policy?

Some drone insurance providers only offer annual cover. But if you are an infrequent flyer, you may not need to pay for protection 365 days a year. Consider if it will work out more cost effective to take out a short-term policy, and just pay for the days you actually fly!

4. What support and service will you get if you ever need to make a claim?

Everyone knows, the true value of insurance is usually only realised at the point you come to make an actual claim. Take the time to do your research first. Speak to other drone operators to get their word-of-mouth recommendations based on their own experiences, or check review sites such as Feefo and Trustpilot to see what other people are saying about the service they received.

5. How is the maximum public liability limit actually calculated?

This is a really important question to ask, as there are different ways the maximum limit amount is calculated based on the type of policy you select:

- Option 1 – provides a maximum liability amount for each separate incident.

- Option 2 – An aggregated limit, so it’s the maximum amount paid out by your policy across all claims during the policy term.

- Option 3 – A shared, aggregated policy (e.g. through a group membership), that covers all members collectively.

Consider the options against your own needs and make sure you know which option applies in case you ever need to make a claim.

6. Where will you actually be covered to fly?

Both your work and adventures can take you all over the globe but not all countries will be included under a drone insurance policy. Make sure you check where you intend to fly against the countries permitted under the policy to ensure it actually meets your needs.

7. Would you be covered for invasion of privacy or data liability events?

Standard public liability insurance does not always include protection for claims related to invasion of privacy or data liability events. Make sure you read the full policy conditions and understand what it is that you are actually covered for.

8. Are there any limits on your annual turnover?

Consider what your annual turnover is as a commercial operator. Make sure you read the full policy conditions to check if there is a cap on the amount you are actually allowed to earn. Opt for an insurance policy that either doesn’t limit your annual turnover, or where the cap exceeds your potential earnings.

9. Will you need to add additional insureds to your policy?

As a commercial operator, do you receive requests to add an additional insured to your policy, to ensure your clients are also protected in the event of a liability claim? Check if additional insureds can be added to your cover, and what charges will apply.

10. Are there any restrictions to your policy?

Some drone insurance products will limit the number of flying hours, drones or pilots on a policy. It’s also common to see restrictions for high-risk premises and drones over a certain weight, so it’s important to check the policy conditions against your own needs.

11. Does the company you are buying your cover from hold the proper regulatory permissions?

Regulated insurance companies must follow strict rules set by the Financial Conduct Authority. These rules are designed to protect you by ensuring your fair treatment, transparency in both the policy terms and pricing, and the reliable processing of claims. You can check the company’s status on the FCA register at Register Home Page.

12. How will your insurance needs change over time?

It’s important that you pick a drone insurance product that can evolve with your needs over time. Consider the likelihood of your businesses’ annual turnover or even the size of the equipment you use increasing over the next 12 months. Would you still be covered and fully protected?

Selecting the right commercial drone liability insurance goes beyond meeting regulatory requirements and ticking a compliance box, it’s about ensuring genuine protection and peace of mind for your business. By considering these 12 essential questions early in the process, you’ll be well-positioned to choose a policy that truly fits your operational needs.